Raise Capital Faster for Your Biotech

Access curated investor lists with verified emails, investment focus, typical check size, and geography. Get in front of the right biotech investor, instantly.

Stop searching. Start pitching.

Handpicked biotech VCs with emails & filters that matter, ready when you are.

Secure Biotech Funding Faster

We deliver curated VC lead lists and investor profiles for life sciences founders raising capital. Access direct contacts (emails) of biotech-focused venture capitalists, filtered by, investment focus (e.g., therapeutics, med tech, digital health), ticket size (250K–10M), and geographic focus. Our data reveals investor priorities past deals, portfolio trends, and funding criteria so you can pitch the right backers, faster.

No more cold outreach. We specialize in biotech fundraising, offering:

- Hyper-targeted VC databases.

- Actionable insights to align your pitch with investor demand.

Stop wasting time on mismatched leads. Close rounds smarter with precision data.

Find Your Investor With BioxList

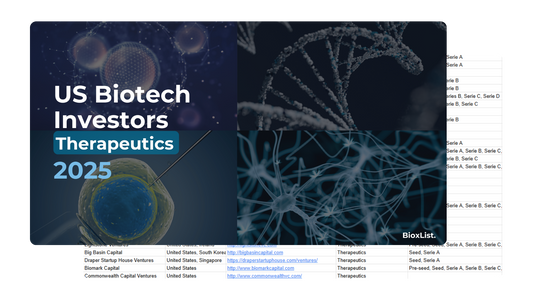

A curated list of 499 US Biotech Venture Capital firms investing across Therapeutics, MedTech, Diagnostics, Biotechnology, Life Sciences IT/AI, Digital Health, and AgriTech.

| Venture Capital | Website | Biotech Sectors | Investment Stages | Location | Contacts |

|---|

Customers are saying

FAQ

What makes your database unique?

- Biotech-only focus: No noise from unrelated industries.

- Deep investor profiles: Funding criteria and even which scientific milestones they prioritize.

Why get a biotech-specific database?

- Save 100+ hours: Replace guesswork with a ready-to-pitch list of investors pre-filtered by your stage, therapy area, and capital needs.

- Avoid mismatches: Know which VCs are actively deploying capital in your niche.

- Boost credibility: Use insider data to craft pitches that resonate with investor priorities.

Who uses BioxList?

- Biotech founders raising Seed to Series C rounds.

- Business development teams at life sciences startups.

- Consultants building investor pipelines for clients.

How to use your database?

Receive an Excel file to manually browse and filter investors by stage, investment focus, or ticket size, then export emails from the CSV file for instant outreach to VC decision-makers. No tech skills required.

Your Precision Fundraising Toolkits :

-

2025 US Biotech Investors - All Sectors List

Regular price €513,63 EURRegular priceUnit price / per -

2025 US Biotech Investors - Therapeutics List

Regular price €557,81 EURRegular priceUnit price / per

Blog

View all-

Essential Metrics Every Biotech Founder Should ...

Learn about the key metrics biotech founders should track to attract venture capital. Understand the role of financial, scientific, and operational metrics in decision-making.

Essential Metrics Every Biotech Founder Should ...

Learn about the key metrics biotech founders should track to attract venture capital. Understand the role of financial, scientific, and operational metrics in decision-making.

-

Top 50 MedTech Venture Capital (VC) Firms

Explore our comprehensive guide on the top 50 MedTech Venture Capital Firms, their investment strategies, and future prospects in the MedTech VC landscape.

Top 50 MedTech Venture Capital (VC) Firms

Explore our comprehensive guide on the top 50 MedTech Venture Capital Firms, their investment strategies, and future prospects in the MedTech VC landscape.

-

Why Participation Rights Can Eat into Your Biot...

Discover how participation rights can impact your biotech exit strategy. Learn the potential downsides and how to mitigate them. A must-read for biotech entrepreneurs and investors.

Why Participation Rights Can Eat into Your Biot...

Discover how participation rights can impact your biotech exit strategy. Learn the potential downsides and how to mitigate them. A must-read for biotech entrepreneurs and investors.