The Future of MedTech Funding: Where the Money Goes

Share

The MedTech industry, known for its innovative solutions and life-saving technologies, relies heavily on consistent and substantial funding. This article delves into the current state of MedTech funding, examining the roles of venture capital, government initiatives, and crowdfunding. We will explore the trends, challenges, and future predictions that shape the financial landscape of this vital sector, providing insights into how MedTech companies can navigate the complexities of securing funding to drive innovation and improve healthcare outcomes.

Key Takeaways

- MedTech funding faces current challenges but shows promising trends across multiple funding sources.

- Venture capital remains crucial for MedTech growth despite emerging challenges and market shifts.

- Government funding and regulations significantly shape the future landscape of MedTech investments.

- Crowdfunding emerges as a viable alternative funding source with unique benefits for MedTech.

- Technology advancements will drive future MedTech funding trends while creating new risks.

Understanding the Current State of MedTech Funding

Overview of MedTech Industry

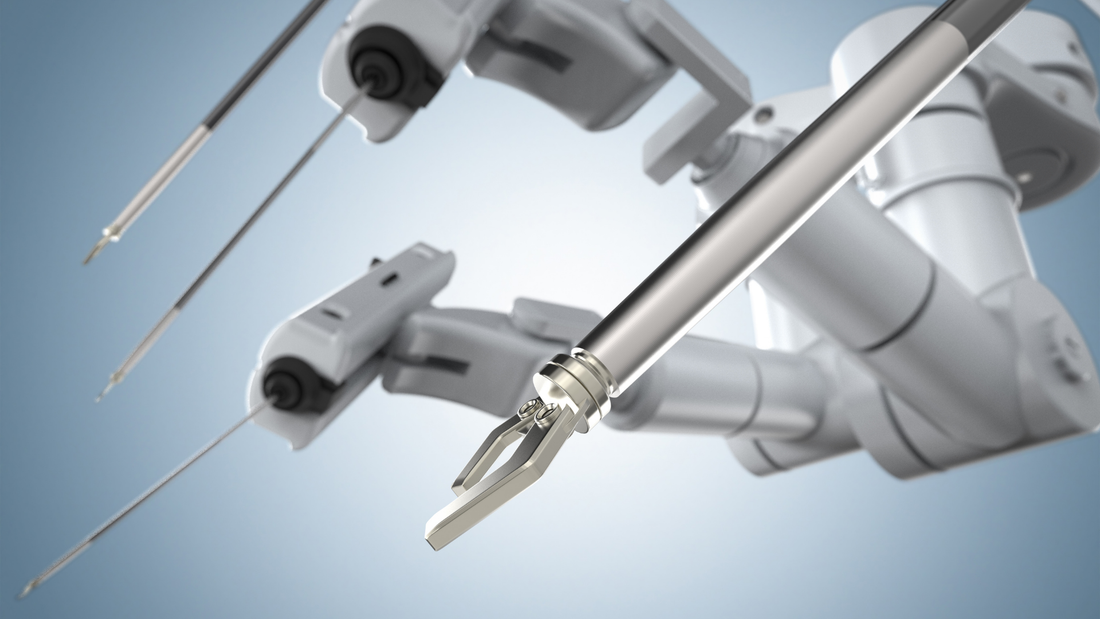

The MedTech industry encompasses a broad spectrum of companies involved in the research, development, and manufacturing of medical devices, equipment, and diagnostics. These innovations range from advanced imaging systems and robotic surgery platforms to implantable devices and point-of-care diagnostics. The industry is characterized by its high R&D intensity, long development cycles, and stringent regulatory requirements, all of which contribute to its significant capital needs.

MedTech plays a crucial role in improving healthcare delivery, enhancing patient outcomes, and reducing healthcare costs. The global MedTech market is substantial, with continuous growth driven by factors such as an aging population, increasing prevalence of chronic diseases, and technological advancements. This growth attracts significant investment, making the funding landscape a critical aspect of the industry's overall health and sustainability.

Current Funding Trends

Currently, MedTech funding is influenced by several key trends. Venture capital remains a primary source of funding for early-stage and growth-stage companies, particularly those developing disruptive technologies. Strategic partnerships and acquisitions by larger MedTech corporations also play a significant role, providing both capital and market access for smaller, innovative firms.

Government grants and initiatives, such as those from the National Institutes of Health (NIH) and other public funding agencies, support basic research and early-stage development. Crowdfunding has emerged as an alternative funding source, especially for consumer-focused MedTech products and solutions. However, the overall funding environment can fluctuate based on macroeconomic conditions, investor sentiment, and regulatory changes.

Challenges in Securing MedTech Funding

Securing funding in the MedTech industry presents several unique challenges. The long development timelines and high regulatory hurdles associated with medical devices and diagnostics increase the risk and cost of investment. Clinical trials, regulatory approvals, and market adoption can take years and require substantial capital, making investors more cautious.

Reimbursement policies and healthcare reforms also impact the attractiveness of MedTech investments. Uncertainty around reimbursement rates and coverage decisions can deter investors, particularly for innovative technologies that lack established market pathways. Additionally, competition for funding is intense, with numerous companies vying for limited capital resources. Companies must demonstrate a clear value proposition, strong clinical evidence, and a viable business model to attract investors.

The Role of Venture Capital in MedTech Funding

The Importance of Venture Capital

Venture capital (VC) is a critical source of funding for MedTech companies, particularly during the early and growth stages. VC firms provide the capital necessary to develop and commercialize innovative technologies, often filling the funding gap between initial seed funding and later-stage investments. VC investors typically bring not only financial resources but also industry expertise, strategic guidance, and access to networks.

VC funding enables MedTech companies to conduct crucial research and development, navigate regulatory pathways, and build commercial infrastructure. The involvement of reputable VC firms can also enhance a company's credibility and attract additional investors. Venture capitalists play a vital role in identifying and nurturing promising MedTech startups, driving innovation and advancing healthcare solutions.

Emerging Venture Capital Trends

Several emerging trends are shaping the role of venture capital in MedTech funding. There is a growing interest in digital health technologies, including telehealth platforms, wearable devices, and AI-powered diagnostic tools. These technologies offer the potential to improve healthcare access, reduce costs, and enhance patient engagement, attracting significant VC investment.

Personalized medicine and genomics are also gaining traction, with VC firms investing in companies developing targeted therapies and diagnostic tests. Furthermore, there is an increasing focus on early-stage investments and seed funding, as investors seek to identify and support promising technologies at their inception. The rise of specialized MedTech VC funds and corporate venture arms is also influencing the funding landscape, providing tailored support and expertise to portfolio companies.

Venture Capital Challenges for MedTech

Despite its importance, venture capital funding for MedTech companies faces several challenges. The long development timelines and high regulatory hurdles associated with medical devices and diagnostics can deter some VC investors, who may prefer investments with shorter time horizons and lower risk profiles. Clinical trial failures and regulatory setbacks can also significantly impact the value of VC-backed MedTech companies.

Reimbursement uncertainties and healthcare reforms add to the complexity of VC investing in MedTech. The need for substantial capital to reach commercialization can also be a barrier, particularly for companies developing complex or novel technologies. VC firms must carefully assess the market potential, regulatory pathway, and reimbursement landscape of MedTech investments to mitigate these risks.

Government Funding and Regulatory Impact on MedTech

Impact of Government Funding

Government funding plays a crucial role in supporting basic research and early-stage development in the MedTech industry. Agencies such as the National Institutes of Health (NIH) provide grants and funding opportunities for researchers and companies working on innovative medical technologies. These grants often support high-risk, high-reward projects that may not attract private investment.

Government funding can also help bridge the funding gap for companies developing technologies with significant public health benefits. Initiatives such as the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs provide funding for small businesses to develop and commercialize innovative technologies. Government support can accelerate the development of new medical devices and diagnostics, ultimately improving healthcare outcomes.

Role of Regulations in MedTech Funding

Regulations have a significant impact on MedTech funding, influencing the cost, timeline, and risk associated with bringing new products to market. The U.S. Food and Drug Administration (FDA) regulates medical devices and diagnostics, requiring companies to demonstrate safety and efficacy through clinical trials and regulatory submissions. Compliance with these regulations can be expensive and time-consuming, affecting the attractiveness of MedTech investments.

Changes in regulatory policies can also impact the funding landscape. Streamlined approval pathways, such as the FDA's Breakthrough Devices Program, can accelerate the development and commercialization of innovative technologies, attracting investment. Conversely, stricter regulatory requirements or delays in the approval process can deter investors. Companies must navigate the regulatory landscape effectively to secure funding and bring their products to market.

Future Predictions on Government Involvement

Future predictions suggest that government involvement in MedTech funding will continue to be significant. Increased funding for basic research and early-stage development is expected, particularly in areas such as personalized medicine, digital health, and AI-powered diagnostics. Government initiatives to support innovation and address unmet medical needs are likely to expand.

Regulatory policies are also expected to evolve, with a focus on streamlining approval pathways and promoting innovation while ensuring patient safety. Greater collaboration between government agencies, industry, and academia is anticipated, fostering a more efficient and effective MedTech ecosystem. Government support will remain crucial for driving innovation and improving healthcare outcomes in the future.

Crowdfunding and its Prospects in MedTech Funding

Understanding Crowdfunding in MedTech

Crowdfunding has emerged as an alternative funding source for MedTech companies, particularly those developing consumer-focused products and solutions. Crowdfunding platforms allow companies to raise capital from a large number of individuals, typically in exchange for rewards or equity. This approach can be particularly useful for early-stage companies that may not yet be ready for venture capital funding.

In the MedTech industry, crowdfunding can be used to fund the development of wearable devices, health monitoring tools, and other consumer health products. It can also be used to support research and development efforts or to launch pilot programs. Crowdfunding offers a way for companies to engage directly with potential customers and build a community around their products.

Benefits of Crowdfunding for MedTech

Crowdfunding offers several benefits for MedTech companies. It provides access to capital without diluting equity or incurring debt. It also allows companies to validate their product ideas and gauge market demand before investing heavily in development. Crowdfunding campaigns can generate valuable publicity and build brand awareness.

Furthermore, crowdfunding can create a community of early adopters and advocates who are invested in the company's success. This community can provide valuable feedback, support, and word-of-mouth marketing. Crowdfunding can be a powerful tool for MedTech companies looking to launch innovative products and build a loyal customer base.

Potential Challenges in Crowdfunding

Despite its benefits, crowdfunding also presents several challenges for MedTech companies. Raising sufficient capital can be difficult, particularly for projects that require significant funding. Crowdfunding campaigns require careful planning, execution, and marketing to be successful. Companies must effectively communicate their value proposition and engage with potential backers.

Regulatory compliance is also a concern, as MedTech companies must ensure that their crowdfunding activities comply with securities laws and other regulations. Protecting intellectual property and managing investor expectations are also important considerations. Crowdfunding may not be suitable for all MedTech companies, particularly those developing highly regulated or complex technologies.

Future Predictions for MedTech Funding

Predicted Trends in MedTech Funding

Several trends are expected to shape the future of MedTech funding. Digital health technologies, including telehealth platforms, wearable devices, and AI-powered diagnostic tools, are likely to attract increasing investment. Personalized medicine and genomics will also continue to be areas of focus, with VC firms and strategic investors seeking opportunities in targeted therapies and diagnostic tests.

Early-stage investments and seed funding are expected to grow, as investors seek to identify and support promising technologies at their inception. Strategic partnerships and acquisitions by larger MedTech corporations will remain a significant source of funding and market access for smaller, innovative firms. The overall funding environment is expected to be dynamic, with fluctuations based on macroeconomic conditions, investor sentiment, and regulatory changes.

Impact of Technology Advancements

Technology advancements will have a profound impact on MedTech funding. The rise of artificial intelligence (AI) and machine learning (ML) is driving innovation in diagnostics, drug discovery, and personalized medicine, attracting significant investment. Advances in robotics and automation are transforming surgical procedures and manufacturing processes, creating new opportunities for MedTech companies.

The development of new materials and nanotechnology is enabling the creation of more advanced medical devices and implants. These technological advancements are driving the need for new funding models and investment strategies. MedTech companies that can leverage these technologies to create innovative solutions are likely to attract significant capital.

Potential Risks and Challenges for MedTech Funding

Despite the positive outlook, several potential risks and challenges could impact MedTech funding. Regulatory hurdles and reimbursement uncertainties remain significant concerns for investors. Clinical trial failures and product recalls can also significantly impact the value of MedTech investments. Economic downturns and geopolitical instability can reduce investor confidence and decrease funding availability.

Competition for funding is intense, with numerous companies vying for limited capital resources. Companies must demonstrate a clear value proposition, strong clinical evidence, and a viable business model to attract investors. Navigating these risks and challenges will be crucial for MedTech companies seeking to secure funding and drive innovation in the future.

As MedTech funding continues to evolve with new trends from venture capital to emerging crowdfunding models, connecting with the right investors has never been more crucial for biotech success. Our comprehensive 2025 US Biotech & Life Sciences Investors List provides you with direct access to top-tier biotech investors who are actively funding innovative healthcare solutions and medical technologies. Don't miss out on critical funding opportunities get your complete investor list today and accelerate your MedTech venture's growth.

Before you go…

Navigating the biotech landscape is a crucial step toward innovation and growth, but it's only the beginning. By building strategic connections, understanding key industry players, and accessing extensive investor networks, you maximize your chances of success. Explore our curated articles to deepen your knowledge of biotech investments, emerging technologies, and strategic opportunities.

Related Articles:

- Guide to Biotech Funding: Strategies and Opportunities

- Understanding Biotech Funding: How Much Do They Raise?

- Digital Transformation in Biotech: AI, Big Data, and Investor Interest

- International Biotech Funding: Regional Differences and Opportunities

- Biotech Investment Strategy: A Comprehensive Guide for Savvy Investors

About BioxList

BioxList is the ultimate resource for anyone seeking investors in the biotech industry. Our platform connects you to venture capital firms and pharmaceutical companies actively investing in biotech, with clear details about their focus, typical investment sizes, and how to reach them.

No account creation is needed, just straightforward, accurate, and regularly updated information.

Whether you're a startup or an established company, BioxList simplifies your search for biotech-focused investors.